Paycheck Budget Sheet

You create a budget for each time you get paid, allocating every dollar from each paycheck to bills, expenses and savings. When you base your spending on the money you actually receive instead of your total monthly income, you can avoid prematurely spending cash you won't receive until later in the month.

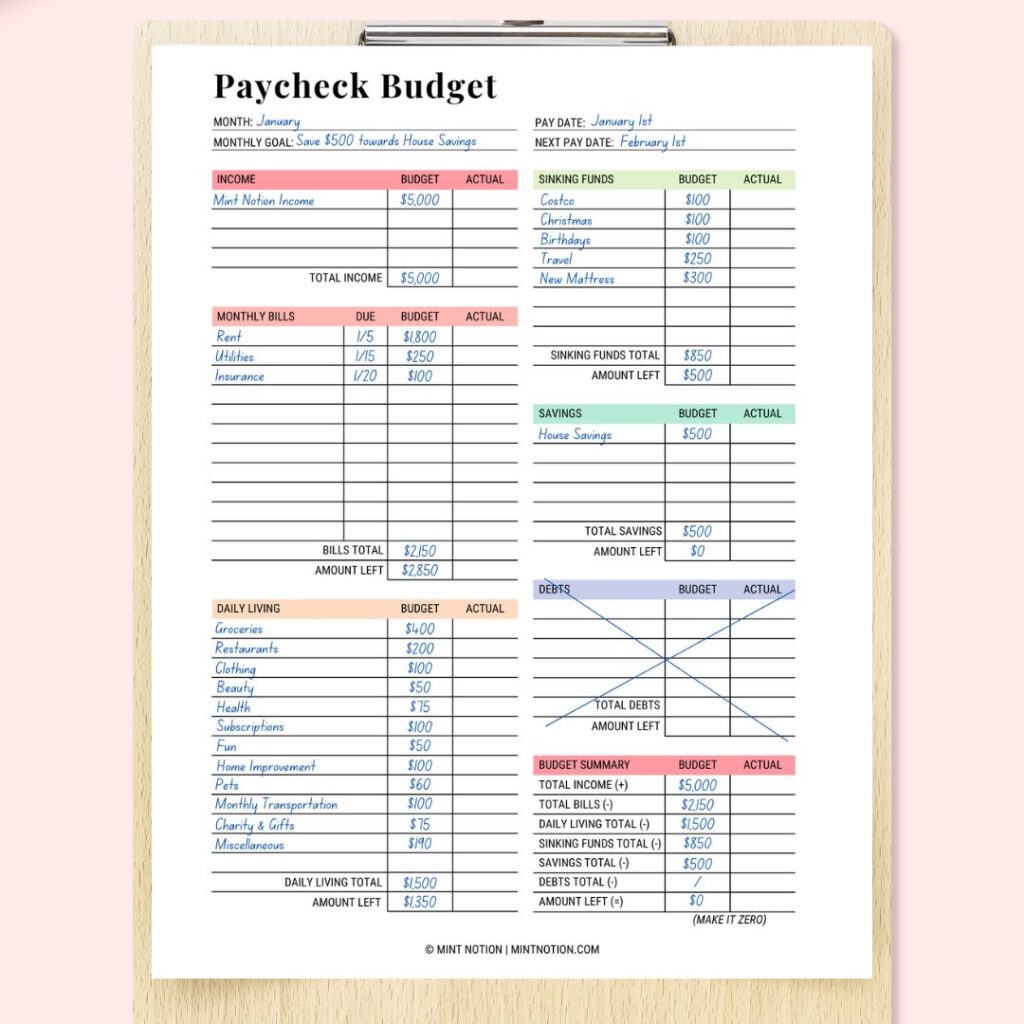

Use this paycheck to paycheck monthly budget printable to create your zero based budget! You

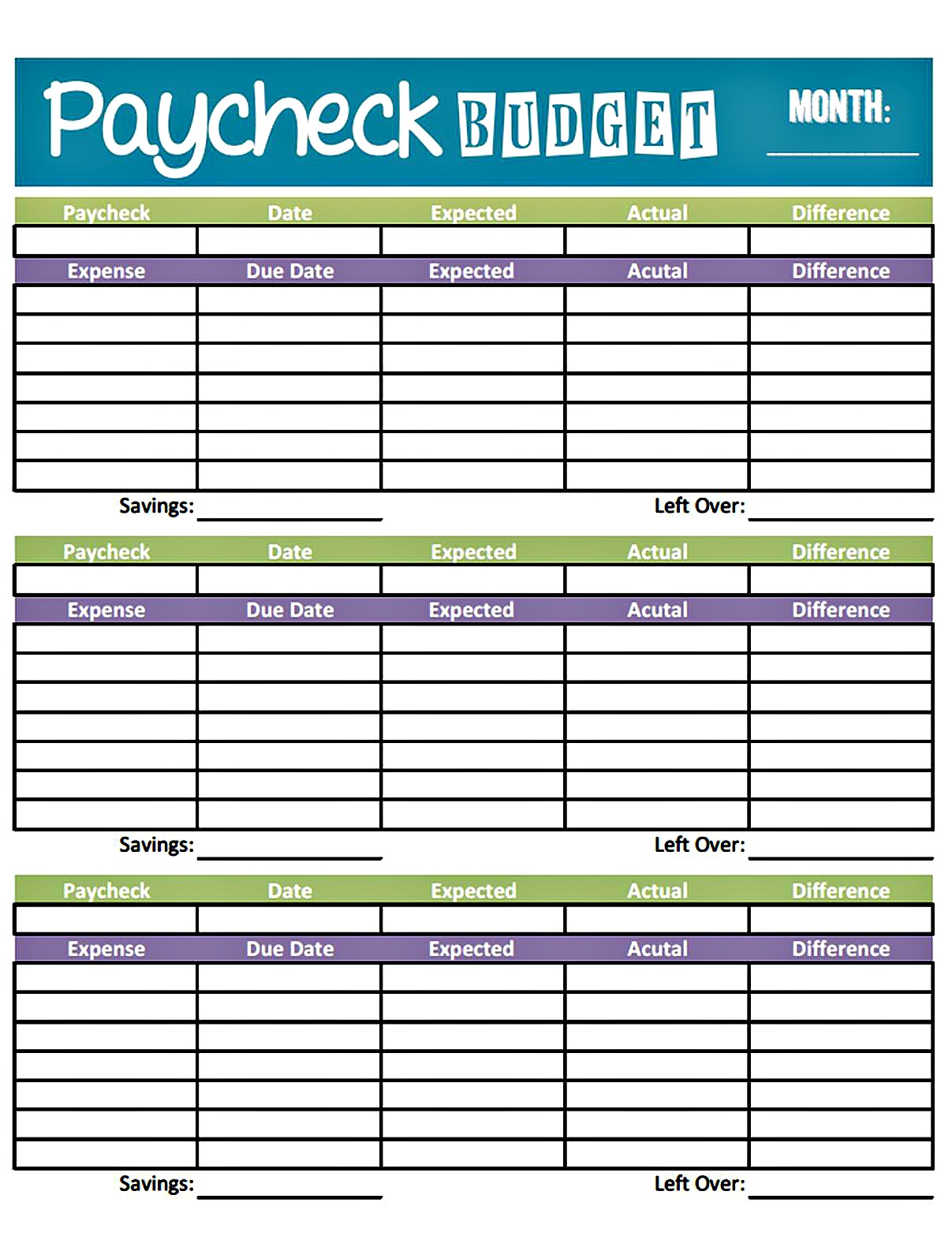

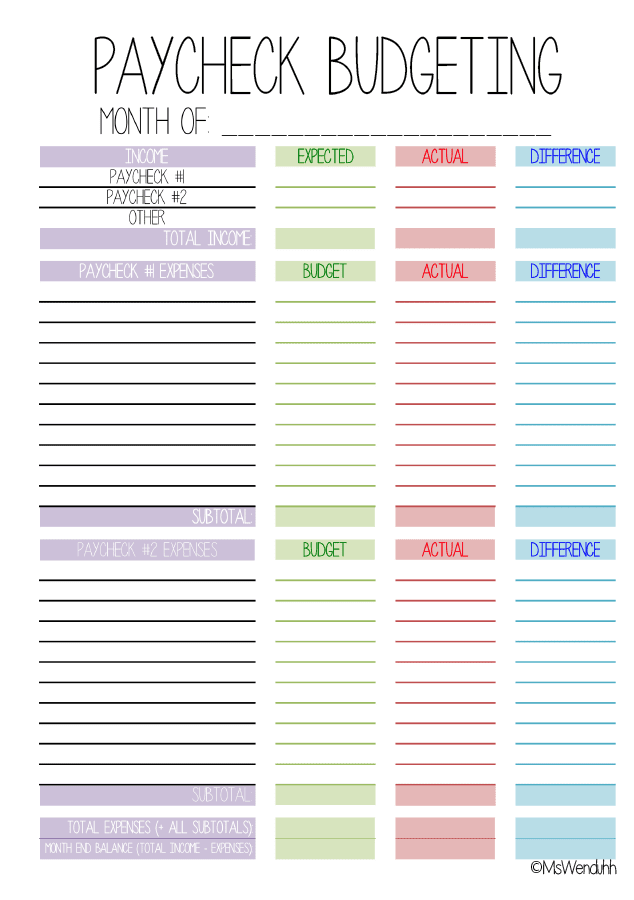

The budget by paycheck method is a great way to manage your money. It is helpful to see your expenses and budget them down each month. The system can be combined with other methods, such as the calendar method, to help you visualize your plan. The Budget by Paycheck Method is popular because it allows you to budget in smaller, more manageable.

Paycheck to Paycheck Budget Printable Zero Based Budget Etsy

Paycheck budgeting means you create a new budget each time you get paid. For most workers, this is usually every two weeks. If you struggle to stick to a traditional monthly budgeting, the budget-by-paycheck method can help you manage and monitor your spending better. Living paycheck to paycheck can be stressful.

Paycheck to Paycheck Budget Template ZeroBased Budget Etsy

What does it mean to budget by paycheck? Budgeting by paycheck is a strategy where, rather than budgeting just once a month, you budget each time you get paid. Because most workers get paid either weekly or biweekly, paycheck budgeting can be a good way to stay involved with your finances.

how to budget when paid every two weeks LAOBING KAISUO

Use a budgeting app. 1. Break Down Your Budget Into Percentages When assessing your fixed and variable expenses, instead of just spending money when you think it's needed, you set percentages. This budgeting method works by assigning a percentage of your paycheck to each category on which you spend money.

Weekly Paycheck Budget Template Addictionary

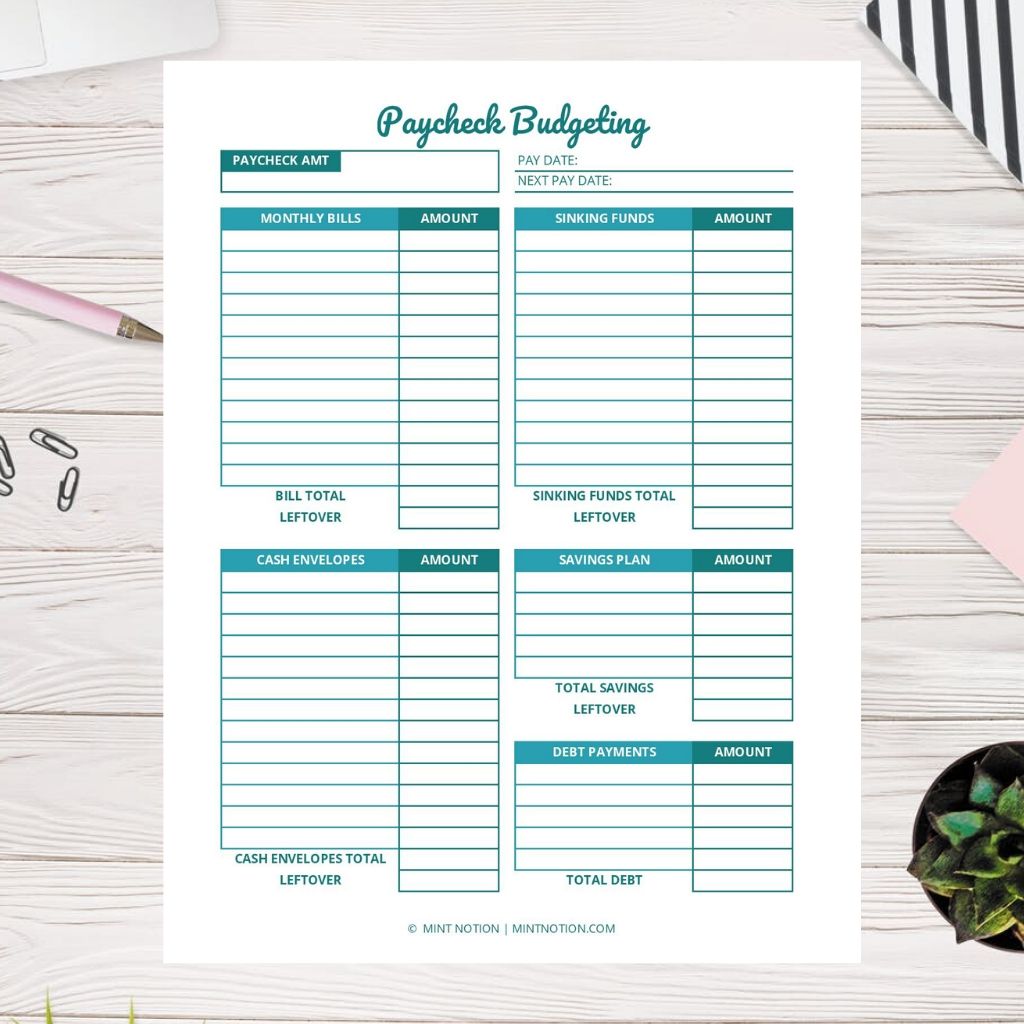

Step #1 - Choose Your Budgeting Tool The first step to budgeting by paycheck is to choose what tool you want to use to create your budget and track your spending. Some options you can use include: Spreadsheet Printable Monthly Calendar Budgeting App Budget Planner

Paycheck to Paycheck Budget Planner Bill Planner Weekly Etsy

Use a Calendar. Use a calendar and write down the dates you get paid and the dates your bills are due with the amount you will pay. Now look at your paycheck dates, and let's say that you get paid bi-weekly. Write down if you are working, and you both get paid bi-weekly. You must write down ALL your bills and income.

Paycheck Budgeting Printable Mint Notion My XXX Hot Girl

Paycheck to paycheck budgeting is a perfect tool if you get paid bi-monthly. Breaking up your expenses to focus on your paychecks works like a charm and allows you to also deal with life's mishaps. So how do you go about starting a paycheck to paycheck budget?

Paycheck Budget Paycheck Planner Paycheck Tracker Etsy Budget Planner Free, Planning Budget

Step 1. Track your expenses No matter what budgeting system you use, I think it is extremely important to track your expenses for a month or two before you establish a written budget. If you don't have any idea how much you're spending, how do you know how much to budget?

Paycheck to Paycheck Budget Printable 1000 Budgeting, Paycheck budget, Money saving strategies

An important part of money management is keeping track of your salary, whether it is regular or irregular income. Paycheck Budget Template will help you keep track of your income, calculate the amount of spending, allocate money to pay utility bills and debts, plan savings, etc. Control every payday, manage money competently, set priorities correctly, become financially independent, and.

Entrepreneur Inspiration Discover Paycheck Budget Printable This paycheck to paycheck budget

Our 50/30/20 calculator divides your take-home income into suggested spending in three categories: 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. The 50/30/20.

Bonfires and Wine Livin' Paycheck to Paycheck Free Printable Budget Form

In 2023, paycheck-to-paycheck living dominated American finances. This sparked a shift to essential spending and a rethink of financial approaches.. embrace budgeting techniques and explore.

paycheck budgeting printable Mint Notion

A Budget by Paycheck means you will create a separate budget each time you get paid. For example, if you are paid bi-weekly and take-home pay is $3500, you will have TWO budgets each month with a starting amount of $3500. To create this budget, you must first confirm your incoming financials.

Paycheck Budgeting Printable Wendaful Planning

If you follow these tips your budget by paycheck will help you achieve the end goals and you can easily save more money. You also love: 30 Personal Finance Tips To Effectively Manage Your Money. Conclusion. If your income comes in multiple different paychecks then using a budget by paycheck is a good way to manage your money.

Paycheck to Paycheck Budget Budget by Paycheck Excel Digital Etsy

There are five basic steps to budgeting by paycheck using this method. Track your expenses Create a calendar Write a budget for each paycheck Pay attention to your budget categories Use the cash envelope system 1. Track Your Expenses Before you can plan out how you'll spend your money, you need to be aware of where it's going, Love advises.

Calendars & Planners Paycheck Budget Printable Paycheck Budgeting Paycheck Budget Printables

Governor Kathy Hochul today unveiled a sweeping consumer protection and affordability agenda, the first plank of her 2024 State of the State. Governor Hochul announced proposals to amend New York's consumer laws to strengthen consumer protections against unfair business practices; establish nation-leading regulations for the Buy Now Pay Later loan industry; advance the first major increase.